The Dissolving Equity Land Trust

How Does It Work?

FEATURES OF A CO-OP

"Landlord-free" rental housing (such as a renter's cooperative) has a number of really nice features.

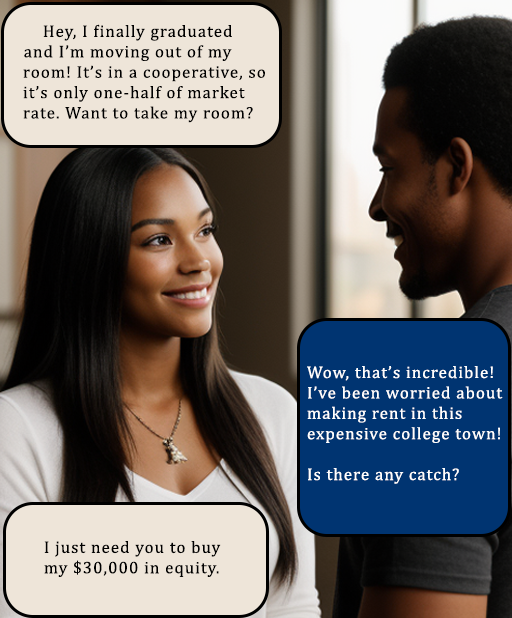

However, there is one major drawback to the cooperative model: the problem of equity payments. While cooperatives dramatically reduce month-to-month rents, they often require expensive buy-ins. This puts cooperative housing out of reach for working-class tenants who need affordable housing the most.

The DELT solves this equity dilemma by distributing equity payments among a much larger number of tenants.

LIFE OF A DELT

The DELT has a three-phase life cycle that reduces effective rents to roughly one-half market rate compared to contemporary commercial rentals.

In a traditional rental model, first you pay back the creditors. Then you pay the creditors for having loaned you money. Then you do that forever.

In a DELT, you pay back the creditors. Then you pay back the people who paid the creditors. Then you're done paying creditors, and you can just enjoy cheap rent forever.

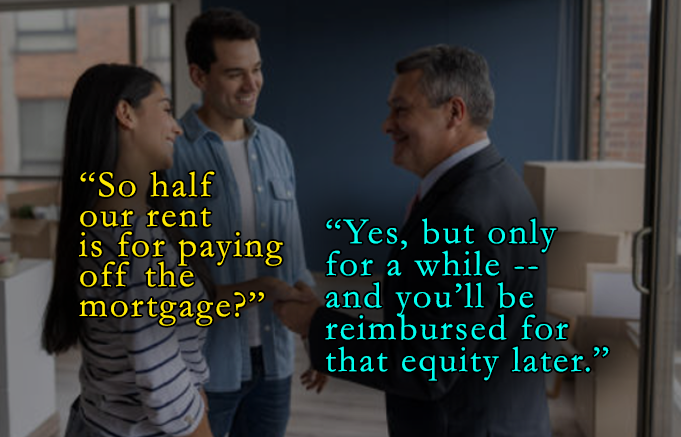

1. The initial phase

Initial buyers front capital to buy a place, and tenants allocate around 50% of their rent to paying off the downpayment and/or mortgage. However, unlike traditional rentals, tenants are issued a future rebate for the portion of their rent that pays off home equity.

2. The dissolving phase

Next, the DELT starts paying back all those rebates.

The rebate offered to tenants slowly goes from 50% to 0% over several years (so we don't make a pyramid scheme).

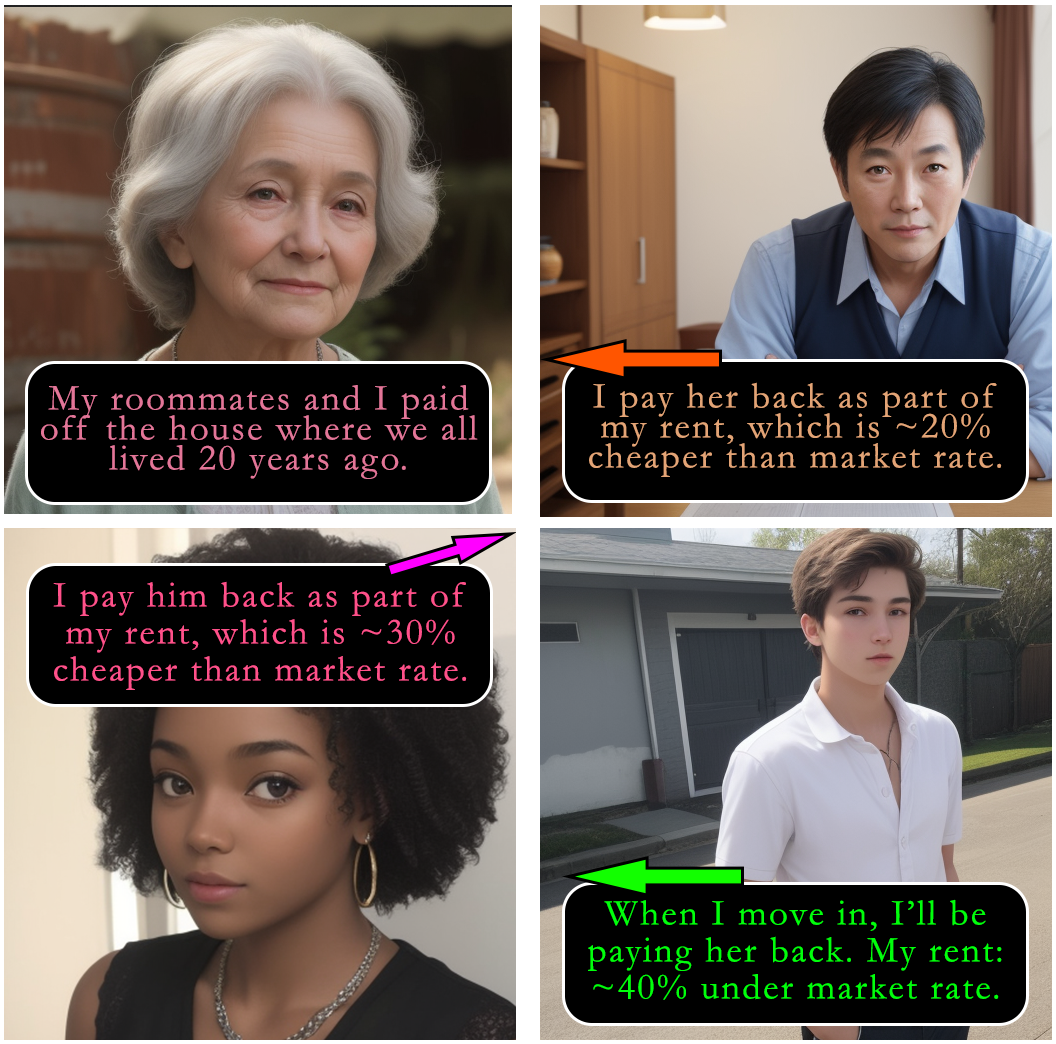

The end phase

Eventually, the home is paid off and the rebates are all done. The DELT is now financially solvent, holding home equity in trust.

While nobody receives a rebate for paying off the house anymore, rent in a mature DELT hovers around one-half of market rate (or possibly less).

The model at work

These graphs show the DELT at work. The top graph shows rent over time; the red line shows market-rate rent continuing to double every decade, with the blue line showing the relatively slow escalation of the cost of homeownership (rising tax or utility payments, etc).

The DELT in green shows the place where the magic happens: rent is held higher than base cost, but as soon as the equity is paid for then the rent accelerates at a dramatically lower rate than commercial rents, eventually converging with a cost like that of homeownership.

The second graph shows debt over time in DELT vs. for-profit rentals. At market-rate rents (red line), tenants quickly pay off the mortgage with no returns.

Since a DELT (green line) is writing IOUs as it also pays off a home loan, its debt increases in the early years. But despite below-market-rate rents, it still pays off its debt over time.

Pretend you're

renting a room!

Fine print:

$500k house; 4 housemates;

20-year mortgage at 7%

100+ year plans break the calculator

| DELT co-op | Private landlord | |

| All your rent: | $0 | $0 |

| Your rebate: | $0 | $0 |

| All-time rent after rebate: | $0 | $0 |

| ...deflated to today's dollars: | $0 | $0 |

| Savings over market rate: | 0% | 0% |

| When you leave, rent is around: | 0% of market rate | 100% of market rate |

More details

Read the more detailed report for a deeper dive on the way this system works.