The Dissolving Equity Land Trust

A proof of concept

A (very) brief history of the rental crisis

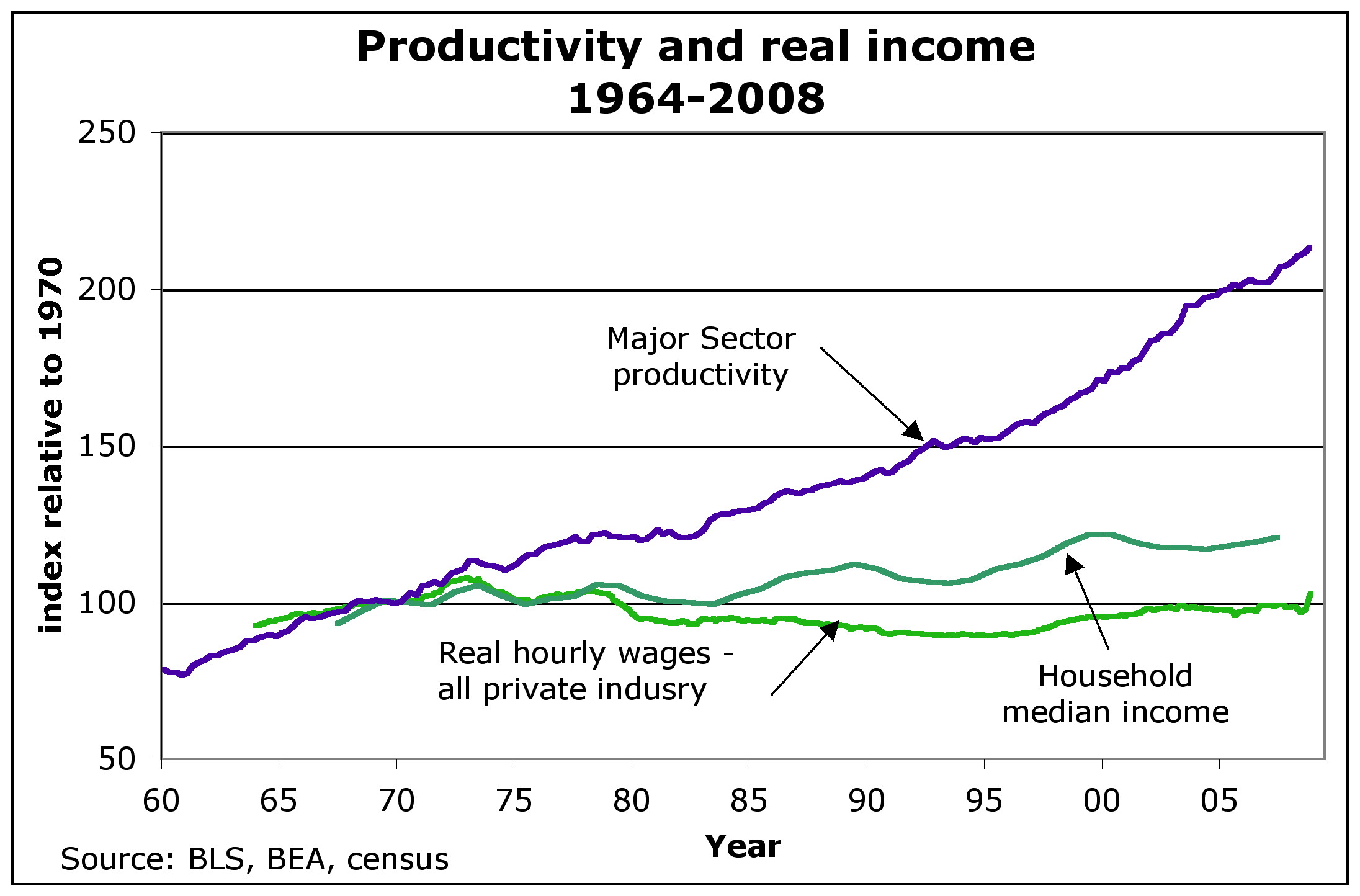

Around the Nixon years, wages stopped keeping up with the cost of living.

Ballooning rents are still included in the gross domestic product even though nothing is produced by scalping a home.

Isn't it just a supply-demand problem?

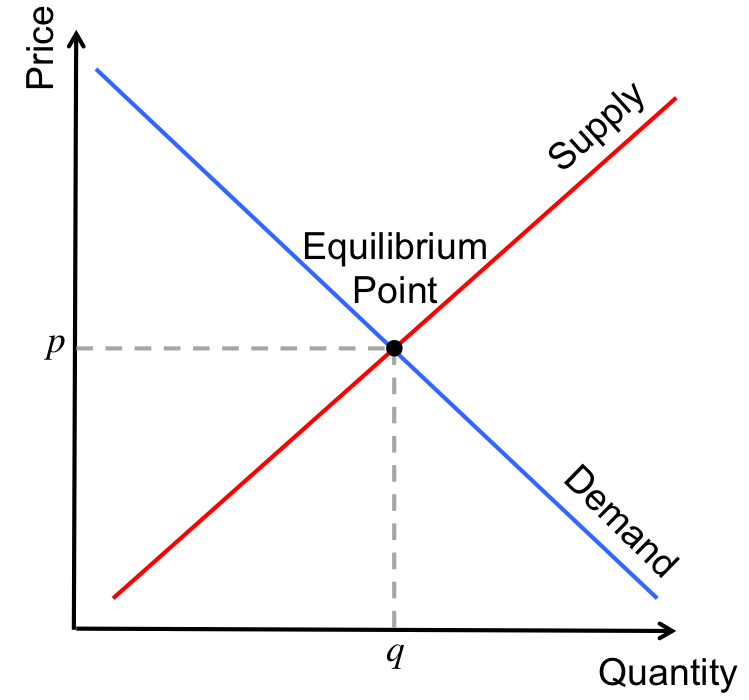

On a supply-demand graph, prices are expected to stabilize if supply stays the same.

But what if someone -- or someones -- reduced the amount of affordable housing by regularly scalping it? "With all other variables held equal," as economists often say, if quantity of an available good is reduced (by being sequestered in investment portfolios, for example), prices rise.

Middle-men create supply problems.

Landlord-free housing cooperatives rent housing at around 1/2 of "fair" market rate.

Vienna bought a ton of housing back from local and foreign rent speculators and successfully reduced market-rate rents by ~50%.

Tenants are used to paying off landlords' 2nd, 22nd, or 2222nd mortgage for them. What if that money instead went toward creating permanently affordable rental housing?

One possible fix (the short version)

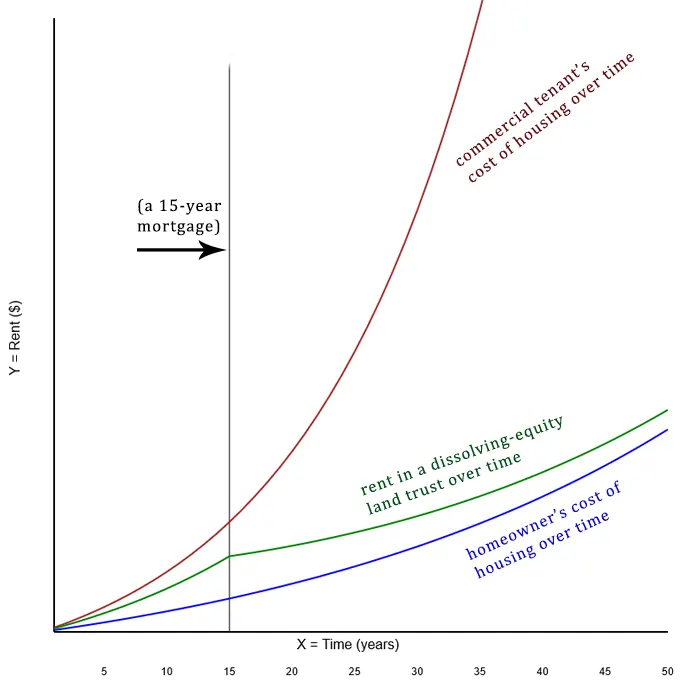

The "dissolving equity land trust" emerges as a unique solution in this environment.

1. Make a down payment.

2. Give tenants a 30-50% rebate on their mortgage payments.

3. Once the home is paid off, the current tenants pay them back.

4. Future tenants also get a rebate -- just a slightly smaller one.

6. Repeat this process until the rebate reaches 0%.

7. By the time the rebate is 0%, rent is ~1/2 of prevailing market rate.

How does it work?

Dive in for more details about the way this system works.

Stay updated

Reach out if you have questions or you'd like to help.